- What Is a Partial Payment?

- Why You Should Offer Flexible Payment Options

- When and How to Use Staggered Payments

- Sample Use Cases

- Tips for Managing Staggered Payments

- Common Mistakes to Avoid

- How to Create an Invoice with Partial Payments Using Pricefic

- Final Thoughts

Managing cash flow is critical for growing businesses. Whether you're launching a custom service, supplying materials for a large order, or onboarding a new client, waiting until the end to get paid puts your finances at risk. That's why many businesses adopt flexible billing practices such as deposits, milestone-based payments, or staged billing to ensure continuity and reduce risk.

In this guide, we'll show you how to confidently implement and manage partial payments, with practical tips and templates to get started right away. Whether you're looking for a partial payment invoice example or simply wondering how to create an invoice with a partial payment request, we've got you covered.

What Is a Partial Payment?

A partial payment refers to any amount paid by a customer that is less than the full total of an invoice. This payment method may be used to:

- Collect a deposit before a project begins

- Accept installments at different stages of a job

- Allow clients to settle overdue balances in smaller chunks

This approach is particularly common in industries like design, construction, consulting, and professional services, where work spans weeks or months and significant upfront investment is required. For projects with defined milestones, consider progressive invoicing to bill as each phase completes.

Why You Should Offer Flexible Payment Options

1. Improves Cash Flow

Receiving a portion of the funds early enables you to cover necessary upfront costs such as materials, labor, and overhead without dipping into reserves.

2. Minimizes Financial Risk

Upfront or milestone-based payments ensure you're not left unpaid after investing time and resources into a project.

3. Encourages Client Commitment

Clients who contribute early are more likely to stay engaged and follow through with the project, reducing the risk of last-minute cancellations.

4. Expands Accessibility

Allowing payments in portions can make your services more affordable and appealing, especially to small businesses or clients on a tight budget.

5. Strengthens Relationships

Offering flexibility builds trust and positions your business as empathetic and professional—especially during uncertain economic times.

When and How to Use Staggered Payments

Implementing a structured approach to staged payments ensures consistency and professionalism. Follow these steps to do it right:

Step 1: Define a Clear Policy

Before offering installment options, outline a policy that includes:

- When such payments are acceptable

- What percentage or amount is typically due upfront (commonly 10%–50%)

- Whether staged payments will incur interest or late penalties

- Deadlines for each installment

Internal consistency helps your team enforce rules confidently and avoids confusion with clients.

Step 2: Set Expectations from the Start

Always communicate your payment structure early in the sales or onboarding conversation. This prevents surprises and gives clients a chance to ask questions or negotiate.

Explain how the initial payment secures their place in your project schedule and enables your team to start work on time.

Step 3: Document It in Your Contract

Your contract should always include:

- The total project cost

- Exact amounts and due dates for each payment

- Any refund or cancellation policies

- Consequences for late or missed payments

This clarity protects both you and the client. It's best to keep language professional and legally sound. Consider referencing a partial payment invoice sample for inspiration.

Step 4: Issue a Proper Invoice

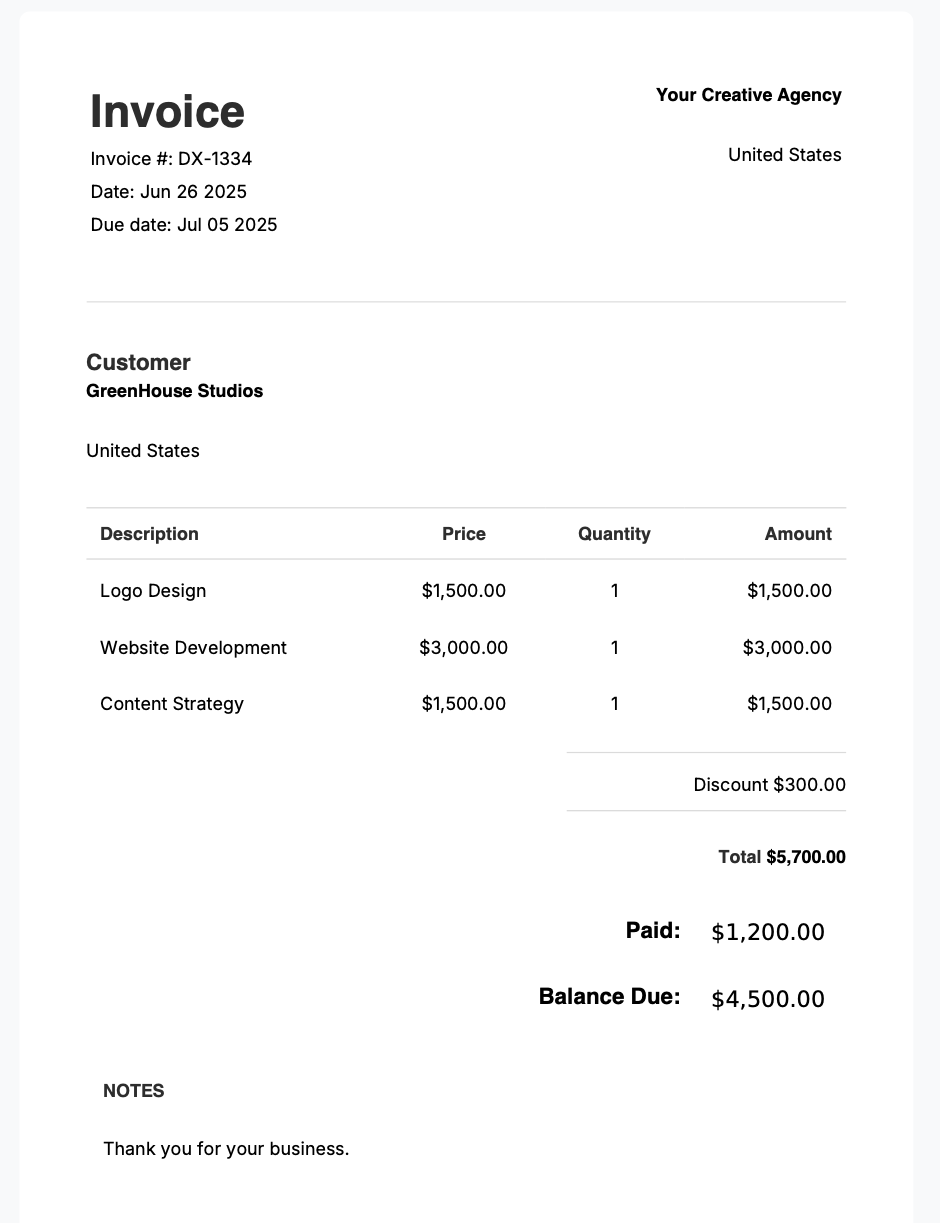

When it's time to bill, issue a clear and professional invoice with partial payment details. Each invoice should include:

- Invoice number and date

- Client and business information

- Full project or order value

- Current amount due

- Description of what the invoice covers (e.g., deposit, milestone)

- Remaining balance and future due dates

- Optional notes for legal or client-specific terms

This document ensures transparency, giving the client a clear understanding of what they're paying for and what's next.

Sample Use Cases

Custom Projects: Collect a deposit to secure materials or begin design work. Milestone Billing: Request payments at 25%, 50%, 75%, and final delivery. Overdue Accounts: Offer a structured payment plan with fixed amounts and firm dates to recover outstanding balances.

Each of these scenarios requires a slightly different format, but the structure of your partial payment invoice should remain consistent and professional.

Tips for Managing Staggered Payments

Even with solid invoices and clear policies, you'll need to stay on top of communication and tracking. Here's how:

1. Track What's Paid and What's Owed

Make sure your invoicing system distinguishes between amounts already received and the outstanding balance. This avoids confusion and errors down the line.

2. Send Confirmations and Reminders

After receiving any amount, immediately send a payment confirmation. Before due dates, send polite reminders—at intervals like 10 days, 3 days, and on the day payment is due.

3. Automate Your Workflows

Instead of managing everything manually, use modern invoicing software like Pricefic to:

- Automatically apply payments to the correct invoices

- Track deposit amounts versus remaining balances

- Send email reminders and confirmations

- Export records for accounting or financial reporting

- View payment status in real-time

Automation keeps your process professional, while reducing administrative overhead.

Common Mistakes to Avoid

Avoiding errors in your invoicing process is key to maintaining credibility and getting paid on time. Watch out for these pitfalls:

❌ Vague or Missing Payment Terms

If your invoice or contract doesn't specify exactly when and how payments are due, you're inviting miscommunication.

❌ Delayed Invoicing

Always issue the invoice promptly—ideally alongside the signed contract or immediately after project kickoff.

❌ Incorrect Balances

Double-check invoice math. A mismatch between what the client thinks they owe and what the invoice says can delay payments.

❌ No Follow-Up

Even the most responsible clients need reminders. Don't assume they'll remember on their own.

❌ No System for Tracking

Trying to manage this manually is prone to error. Use a proper invoicing tool that lets you tag, track, and audit every payment with ease.

How to Create an Invoice with Partial Payments Using Pricefic

Setting up a flexible invoice in Pricefic takes just a few steps and gives you complete clarity over what's been paid and what’s outstanding.

Here’s how to do it:

-

Click here to create an invoice using Pricefic. Add your line items (products or services), apply any discounts or taxes if needed, and save the invoice to your Pricefic account.

-

Saving your invoice will take you to the view page where you’ll see all your billing details neatly presented.

-

Click to “Add Payment” and you’ll be guided through saving an income transaction that references the invoice.

-

Once saved, you’ll be redirected to the invoice view page, now showing the total amount, amount already paid, and remaining balance due, all automatically calculated.

-

You’re not limited to just one invoice style. With Pricefic, you can choose from a wide range of templates to fit your brand.

Pricefic takes care of the math and the formatting so you can focus on doing the work, not chasing payments.

Final Thoughts

Structured payments aren't just for large corporations, they're a practical tool for freelancers, agencies, and small businesses. Whether you're collecting a down payment before starting work, or offering a staged schedule for client convenience, using professional invoices and automation tools is essential.

With a clear policy, strong communication, and support from tools like Pricefic, you can confidently create and send a partial payment invoice that keeps your cash flow healthy and your client relationships strong.